Über 50 Folgen

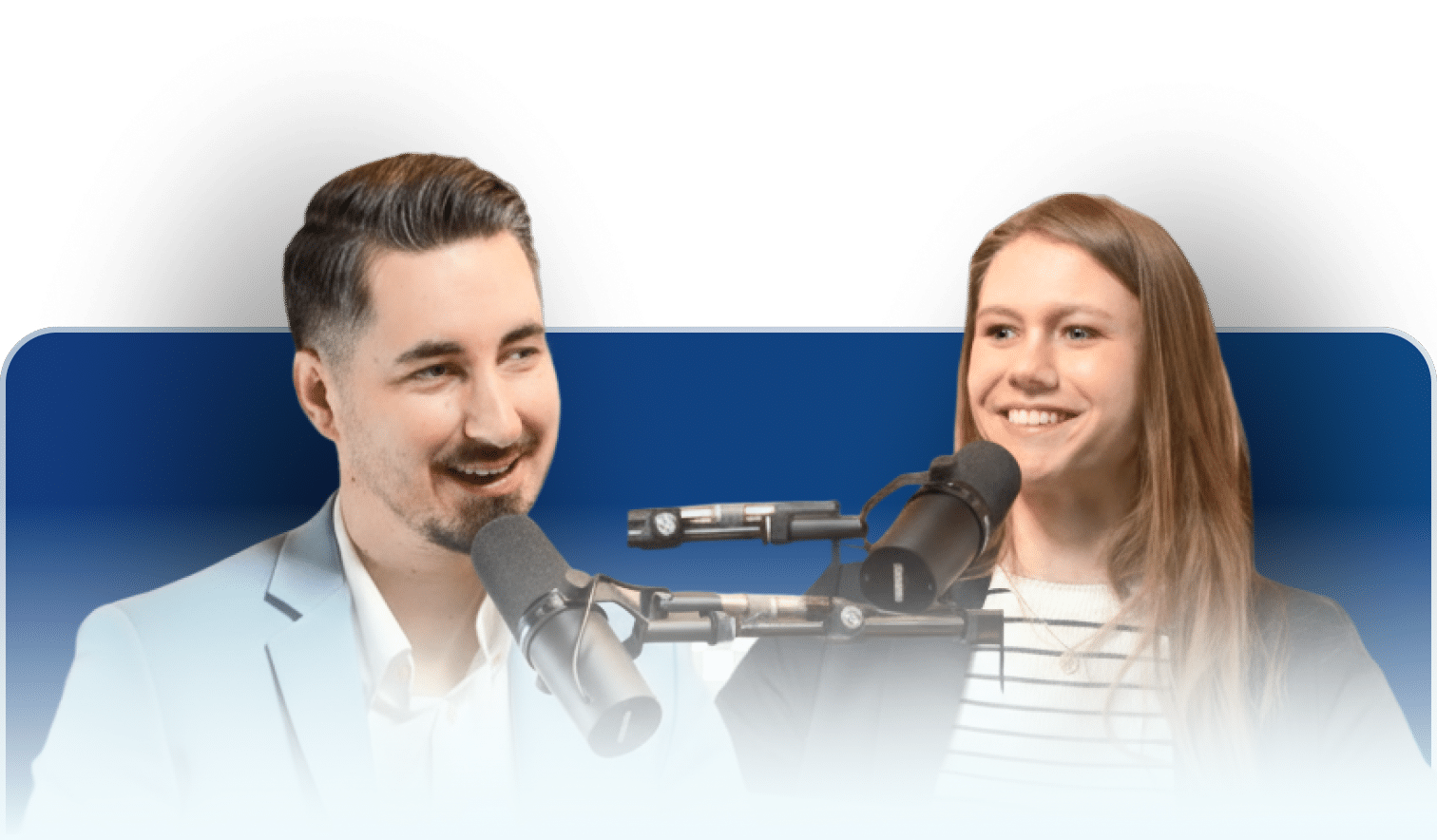

KINDERleicht Investieren – der Podcast von Invest4Kids

Einfach erklärt, direkt umsetzbar – Susanna & Torben zeigen dir, wie du mit ETFs, Steuervorteilen und dem richtigen Mindset das Beste für dein Kind rausholst.

Über den Podcast

Susanna & Torben sprechen über die finanziellen Themen, die Familien wirklich bewegen: clever investieren mit ETFs, Steuervorteile nutzen, finanzielle Erziehung und das richtige Mindset rund ums Geld.

Dazu laden sie regelmäßig spannende Gäste ein, die ihre Erfahrungen und Perspektiven teilen – zu Themen wie Taschengeld, Finanzen in der Partnerschaft, Social Media, politische Entwicklungen und vielem mehr.

Neueste Episoden

Hör direkt in unsere neuesten Folgen rein

data

Title

Beliebte Episoden

Unsere meistgehörten Folgen – ideal für deinen Einstieg

Themenfilter

Du willst tiefer einsteigen? Finde genau die Themen, die dich interessieren – von Steuern über Mindset bis zu cleveren ETF-Strategien

Lerne die Hosts kennen

Hinter KINDERleicht Investieren stehen Susanna & Torben – zwei erfahrene Expert:innen für Kinderinvestments bei Invest4Kids.

Torben ist Mitbegründer von Invest4Kids und hat sich darauf spezialisiert, komplexe Finanzthemen verständlich und greifbar zu machen.

Ich möchte langfristig für Kinder finanzielle Sicherheit und Stabilität schaffen.

Susanna begleitet täglich Familien dabei, clevere Strategien für die finanzielle Zukunft ihrer Kinder zu entwickeln – klar, ehrlich und mit Leidenschaft für das Thema Geldanlage.

Die Zukunft ist unsicher – ein Plan gibt Sicherheit, um Kinder zuverlässig zu unterstützen.

Immer wieder sind auch Eltern aus dem Invest4Kids-Team zu Gast – zum Beispiel Laila und Maike – sowie Gründer Bogdan, die ihre persönlichen Erfahrungen, Perspektiven und Geschichten aus der Beratung teilen.

Bereit, das Beste aus deinem Geld für dein Kind zu machen?

Starte jetzt mit einer Folge, die dich inspiriert – oder entdecke, wie du mit Invest4Kids ganz konkret für dein Kind investieren kannst. Ob du gerade erst anfängst oder schon investierst: Hier findest du Wissen, Motivation und echte Aha-Momente für deine finanzielle Zukunft als Familie.

Wir sind Invest4Kids

Erhalte einen Einblick in unser Büro in Kiel und sieh, wie wir Eltern mit Expertise und Leidenschaft unterstützen.

Unser Standort: Fabrikstraße 7, 24103 Kiel